If you run a seasonal business in New York, you live in extremes. In-season, you’re juggling customers, staff, inventory, and long days. Off-season, you’re trying to stretch cash flow, maintain equipment, and plan for next year. What most people don’t tell you is that your insurance needs shift just as dramatically as your calendar does.

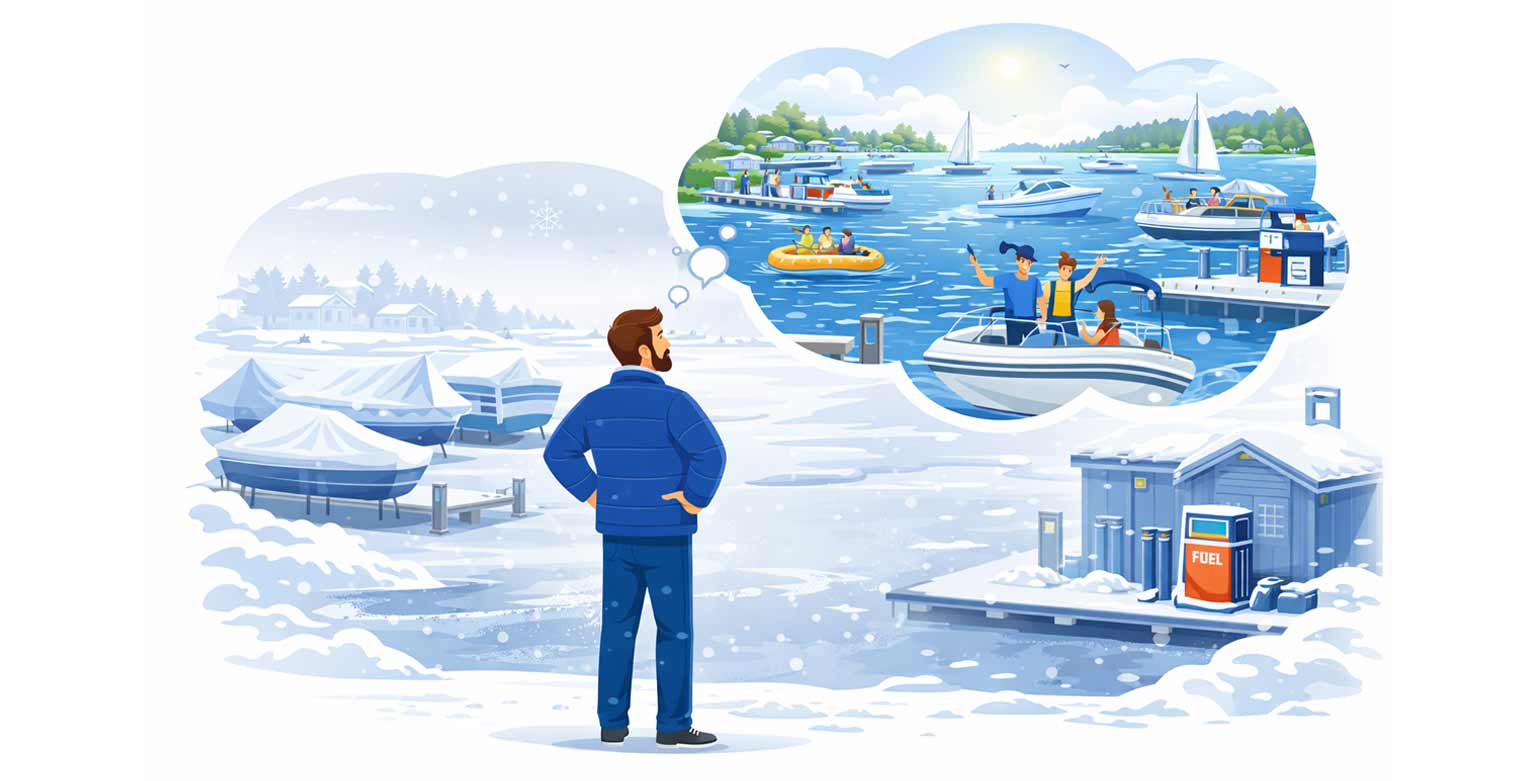

A summer marina on Chautauqua Lake, a ski-town rental business, a landscaping company that’s slammed from April to October, a holiday pop-up retailer—these businesses don’t carry the same risk profile in January that they do in July or December. If your insurance looks exactly the same all year long, it might be too thin when you’re busy and too expensive when you’re not.

At Weed Ross, we work with seasonal operations across Western and Upstate New York, helping owners tune their coverage to real-world peaks and valleys. The goal: make sure you’re properly protected when it matters most, without overpaying when things slow down.

In this article, we’ll cover:

- Why seasonal businesses need a different approach to insurance

- How to identify your true “peak exposure” period

- Key coverages to dial in for your busy season

- Smart ways to adjust limits, endorsements, and policies around your calendar

- How a local independent agency like Weed Ross helps you build a flexible, sustainable plan

Why Seasonal Businesses Need a Different Insurance Strategy

Seasonal businesses are exposed to concentrated risk. You’re handling:

- A surge in customers and foot traffic

- Temporary or short-term employees

- More inventory, equipment, or vehicles in use

- Longer hours and more moving parts across the board

That means more opportunities for claims—just when your revenue is on the line. A slip-and-fall at a lakeside ice cream shop in July, a boating accident at a marina on the Fourth, a snow-removal mishap in January, or equipment failure at a holiday-market stall during your biggest weekend of the year—these hits can wipe out a huge portion of your annual profit if you’re underinsured or misaligned.

On the flip side, during the quiet months, you might not need the same limits or endorsements you rely on when you’re operating full tilt. Your coverage should reflect that rhythm instead of pretending every month looks the same.

Identify Your Peak Exposure

Before you adjust your business insurance policies, you need a clear picture of when and where your risk truly spikes. For most seasonal businesses, the key drivers are:

- Revenue Seasonality: Look at when the majority of your annual revenue lands. If 70% of your income arrives in three or four months, that’s when business interruption or major liability claims would hurt the most.

- Headcount and Labor Mix: Seasonal hiring matters. Bringing on a big wave of temporary workers increases your workers’ comp exposure, training challenges, and the odds of mistakes that can lead to claims.

- Inventory and Equipment Levels: Retailers, rental shops, marinas, landscapers, and contractors often store or deploy far more inventory and equipment in-season. That means higher property values and more gear at risk of damage, theft, or breakdown.

- Customer Volume and Foot Traffic: More visitors, clients, and guests mean more potential for injuries, property damage, and disputes. Premises liability (general liability) becomes much more important during your peak months.

Once you map these pieces to your calendar, you can start building an insurance program that concentrates protection where and when you actually need it.

Core Coverages to Get Right for Peak Season

The basics still matter—but for seasonal businesses, the details matter even more.

General Liability Insurance

This is the backbone for most seasonal operations. General liability responds if someone claims your business caused them bodily injury or property damage—think guest injuries on your property, damage to a customer’s property, or incidents involving your operations off-site.

During peak season, your foot traffic and interaction with the public are at their highest. Make sure your limits are high enough to handle a serious injury claim and that your policy properly reflects your operations (water activities, events, outdoor seating, rentals, etc.).

Commercial Property & Peak Season Coverage

Business property insurance is key. If your inventory, equipment, or stock swings up dramatically during certain months, a static property limit might not cut it. This is where peak season endorsements or flexible property options can help.

A peak season endorsement lets you temporarily bump coverage during specific times of year when your property values are higher—say, a specialty gift shop from October to January, or a rental outfitter from May through September. That way, you’re not underinsured when your building is full, and you’re not overpaying when shelves and storage are lean.

Business Interruption / Business Income

If your entire year depends on a handful of months, even a short shutdown can be brutal. Business interruption coverage is what helps replace lost income and cover ongoing expenses if a covered property loss (like a fire or major storm damage) forces you to slow or stop operations.

For seasonal businesses, you’ll want to:

- Confirm your business income limit realistically reflects what you’d lose at peak

- Check how long coverage lasts and whether it would carry you through or between seasons

- Explore extra expense coverage to help you relocate temporarily or work around a loss

If you can’t afford to lose a big holiday period or your main summer window, this coverage is non-negotiable.

Workers’ Compensation

When you bring on a wave of seasonal staff—servers, dockhands, retail associates, lift operators, grounds crews—your workers’ comp exposure spikes. You’ll want to:

- Accurately project peak payroll and job roles (riskier work = higher exposure)

- Make sure temporary, part-time, and seasonal workers are properly classified

- Invest in basic safety training to reduce injuries and claims

The state cares that you carry workers’ comp when required, but you should care that it’s set up correctly around your actual staffing pattern.

Commercial Auto & Hired / Non-Owned Auto

If you use vehicles for deliveries, events, hauling equipment, or customer transport, winter or summer roads in New York can turn a small mistake into a big claim. Limits reflect the real risk—you don’t want to be underinsured if a serious accident happens during your busiest month. So, it’s always wise to make sure:

- Vehicles used mainly for business are on commercial auto, not personal policies

- You have hired and non-owned auto coverage if employees use their own cars for business errands

Seasonal Tools and Endorsements That Make a Big Difference

Beyond the core coverages, there are a few tools that can be especially useful for seasonal operations.

Peak Season Endorsements

As mentioned earlier, these allow you to schedule higher property limits for specific months when your stock, gear, or revenue exposure is much higher. It’s a clean way to align your insurance values with reality without overpaying year-round.

Inland Marine (Tools, Equipment, and Mobile Property)

If your business involves gear that moves—landscaping equipment, rental gear, contractor tools, event setups—inland marine coverage helps protect those items away from your primary location. Seasonal businesses often rely heavily on portable equipment; insuring it properly is a big deal.

Event or Special Activities Coverage

If your peak season includes festivals, special events, live music, fireworks, races, or community gatherings, you may need additional liability or special event coverage—especially if you’re serving alcohol or hosting large crowds.

Cyber Coverage for Seasonal Booking and Payments

If your busy season involves a rush of online bookings, card payments, or reservation systems (think vacation rentals, marinas, tourism companies, or seasonal attractions), cyber liability insurance becomes part of your risk picture. A well-timed phishing attack or payment-system breach during your peak months can do serious damage.

How Weed Ross Supports Seasonal Businesses in New York

Seasonal businesses don’t need cookie-cutter insurance. They need coverage that flexes with their calendar and cash flow. That’s where being a local independent agency actually matters. At Weed Ross, we:

- Work with 40+ carriers to find options that understand and price seasonal risk correctly

- Help you structure property, liability, auto, workers’ comp, and umbrella coverage around your busy months

- Recommend endorsements like peak season coverage and inland marine when they make sense

- Review your program before and after each season so it evolves with your business

If your year is defined by a few crucial months, your insurance should be built around that reality. Get in touch with the experts at Weed Ross and let’s build a peak-season strategy that protects the business you’ve worked so hard to build—without wasting money when the lights are off and the doors are closed.